If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today’s low mortgage rates. Let’s connect to make sure you don’t miss out. Contact Mo Hadid here.

California REALTOR®

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today’s low mortgage rates. Let’s connect to make sure you don’t miss out. Contact Mo Hadid here.

Fall is quickly approaching and it could pose the perfect opportunity to sell your home. There is no doubt that we are in a seller’s market. Homes are selling at record speeds for top dollar, but it won’t last forever. Keep reading to learn our top five reasons to put your house on the market this Fall.

Your House Will Likely Sell Quickly

Average days on market is a strong indicator of buyer demand. Currently, properties are spending a short amount of time on the market, which is a good indicator that your home could sell just as quickly.

Buyers Competition

Not only are homes selling quickly, but they are also seeing multiple offers. Buyers are coming prepared with the best offer in hand because they know that bidding wars are a likely outcome. Multi offer situations can put the seller in a great financial position.

Inventory is Low

Motivated buyers are challenged with the low housing supply. When inventory is low and demand is high, then your house takes center stage. This sets you up for success by drawing more attention to your home. Now is the time to take advantage of the low inventory before the supply starts to increase.

Home Equity

Competition is driving up the price and causing home price appreciation to rise. As the home’s value appreciates, equity will also increase. This is good news for sellers because the increasing value of your home can give you more money in your pocket to upgrade.

Low Mortgage Rates

Buyers are motivated to purchase thanks to the record low mortgage rates. Throughout 2021 mortgage rates have been low, however, the hot housing market and accelerating inflation point to a probable rise in interest rates by the end of the year. Now is the time for homeowners to take advantage of the rates and lock in unprecedented savings.

Seller’s markets won’t last forever so act now. If you are interested in selling your home contact Mo Hadid with Quest Real Estate today! Click here to discover what your home could be worth today.

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

Here are the latest percentages showing the year-over-year increase in home price appreciation:

The dramatic increases are seen at every price point and in all regions of the country.

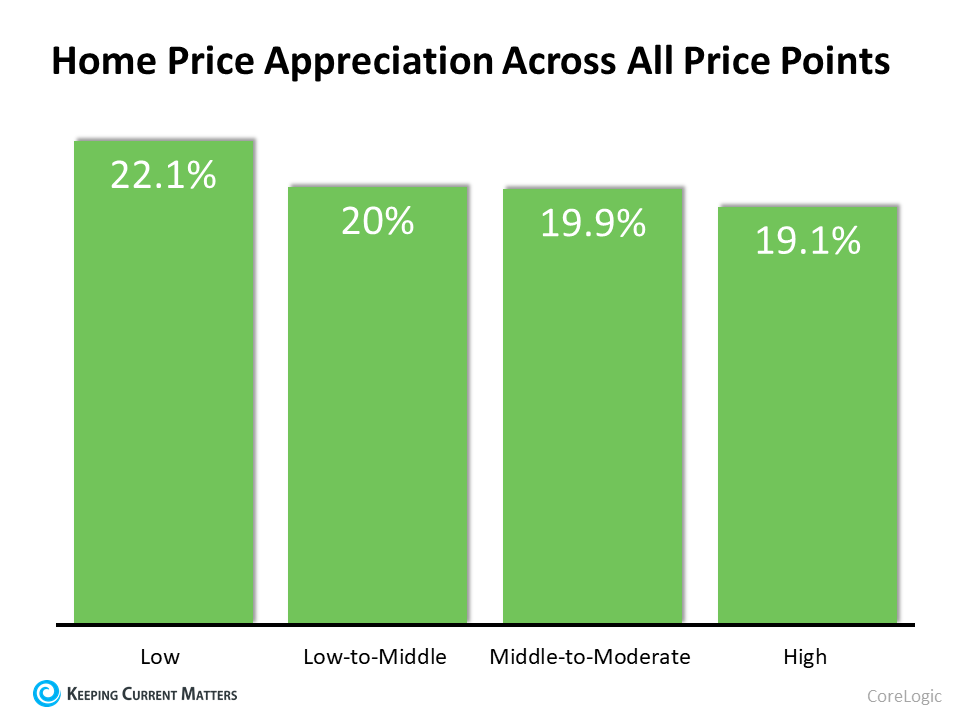

According to the latest Home Price Index from CoreLogic, each price range is seeing at least a 19% increase year-over-year:

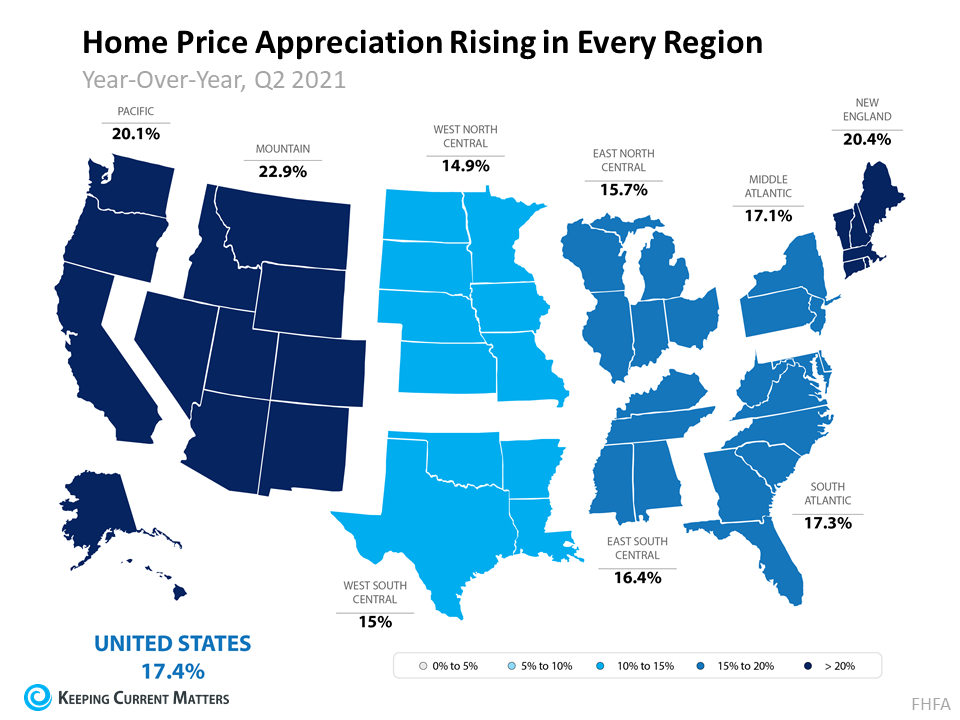

Every region in the country is experiencing at least a 14.9% increase in home price appreciation, according to the Federal Housing Finance Agency (FHFA):

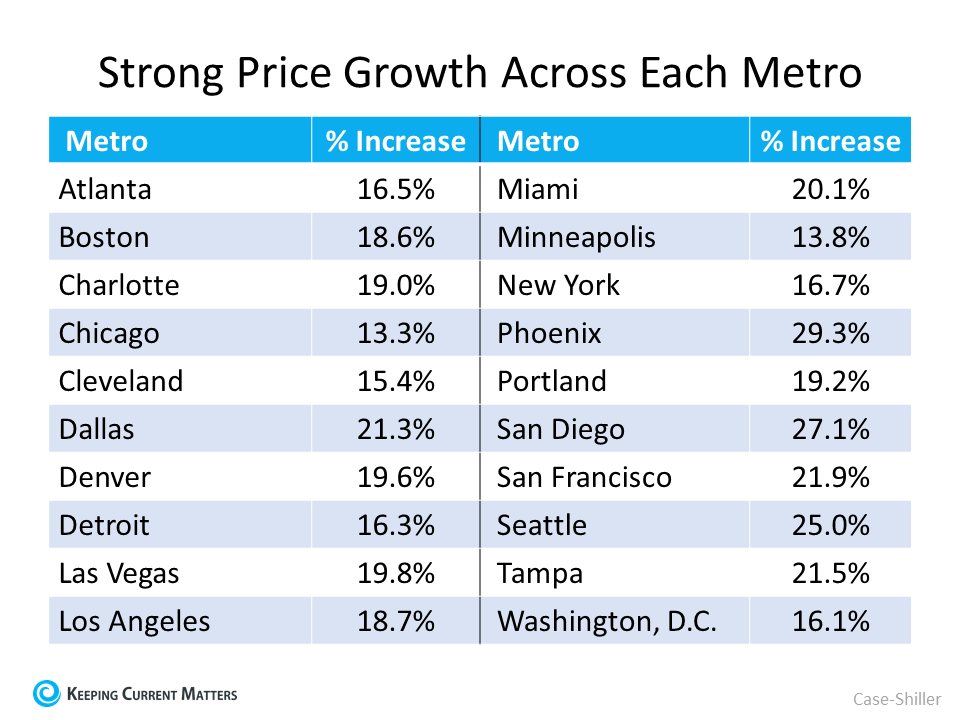

According to the U.S. National Home Price Index from S&P Case-Shiller, every major metro is seeing at least a 13.3% growth in prices (see graph below):

Prices are the result of the balance between supply and demand. The demand for single-family homes has been strong over the last 18 months. The supply of houses available for sale was near historic lows. However, there’s some good news on the supply side. Realtor.com reports:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

There will, however, still be a shortage of supply compared to demand in 2022. CoreLogic reveals:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

Yet, most forecasts call for home price appreciation to moderate in 2022. The Home Price Expectation Survey, a survey of over 100 economists, investment strategists, and housing market analysts, calls for a 5.12% appreciation level next year. Here are the 2022 home appreciation forecasts from the four other major entities:

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021. However, it is still expected to be greater than the annual average of 4.1% over the last 25 years.

If you owned a home over the past year, you’ve seen your household wealth grow substantially, and you’ll see another nice boost in 2022. If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.

Sacramento homes are selling at record speeds. When inventory is low and the buyer demand is high, sellers can see bidding wars and above asking price offers. In a seller’s market, the pricing strategy is key to getting the most for your home.

What is the best pricing strategy?

Listing your home over market value might not be the best strategy. Over-pricing your home can lead to it sitting longer on the market and ultimately having to drop the price. On the opposite end of the spectrum, underpricing can cause the home to lose value and deter skeptical buyers.

The best pricing strategy is to list the home at its market value. A fair-priced house will increase the number of buyers that come to tour the home. Increasing the home’s visibility can cause higher interest. The more competition for the home, the higher chances a bidding war will occur, which will lead you to get more for your home.

How do I find out the fair market value of my home? It is important to get an expert Real Estate agent on your side. With over 30 years of experience, Mo will determine the best list price for your home based on the current market conditions. He will ensure the sale of your home is smooth and successful. Get started now by requesting a Free Home Evaluation.

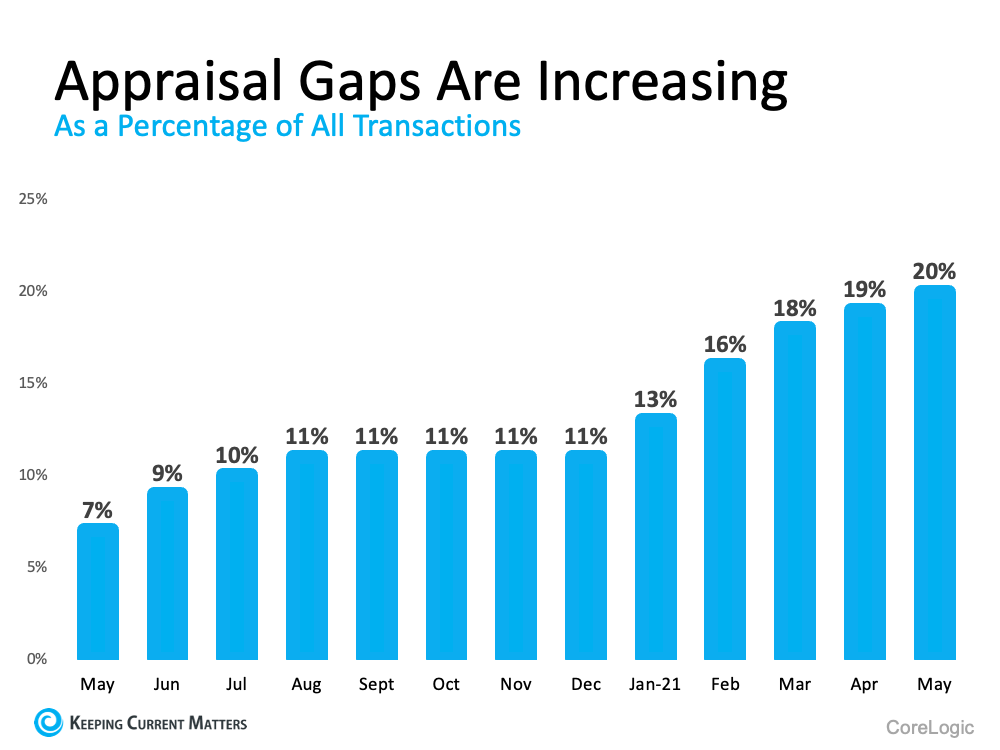

In today’s market, home prices are naturally rising due to low supply and high demand. Home prices are appreciating at near-historic rates, which is creating some difficulties when it comes to home appraisals. An appraisal determines the fair market value of a home. It’s becoming increasingly common for an appraisal to come in below the contract price on the house. The appraisal gap is the difference between the appraisal and the price a buyer is willing to pay.

Appraisal gaps are caused by heightened buyer demand when purchasers are willing to pay over asking to secure the home. Homebuyers may be willing to pay more, but the appraisers are there to assess the market value of the home. When the appraiser comes in, they look at things more objectively compared to an emotional homebuyer. Their goal is to make sure the lender isn’t loaning more money than the home is worth.

In a highly competitive market like today’s, having an inconsistency between the two numbers isn’t surprising. See the graph below for the increasing rate of appraisal gaps, according to data from CoreLogic:

With the increasing rate of appraisal gaps, what do you do? The best thing you can do is understand how an appraisal gap may impact your transaction. When selling, you may encounter an appraisal below your contract price. In today’s seller’s market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers need to be prepared to bring extra money to the table if they really want the home. Whether you are buying or selling, contact Quest Real Estate for help navigating an appraisal gap. We will help you understand your options for the best outcome.