This is the Year to Move

Home prices and mortgage rates are forecast to rise. Let’s connect so you can sell your house and find your next home before it costs more to move.

California REALTOR®

Home prices and mortgage rates are forecast to rise. Let’s connect so you can sell your house and find your next home before it costs more to move.

Don’t give up the search just because you haven’t found a home that checks every box. Let’s connect to see which of your “must haves” can be accomplished after you purchase.

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a homebuyer, what do rates above 3% really mean?

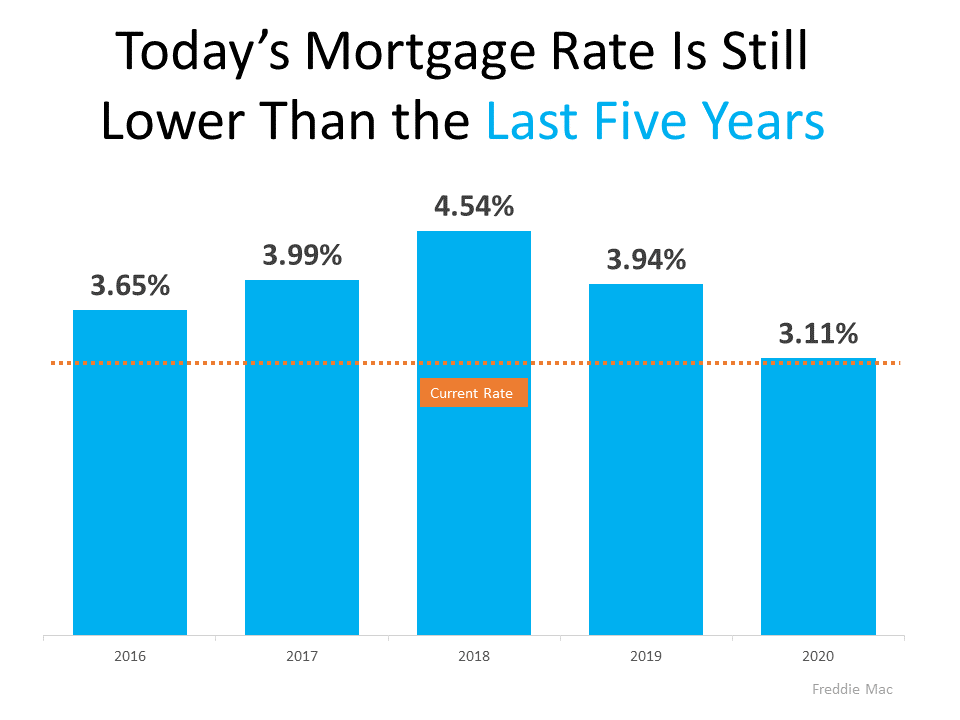

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years: As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

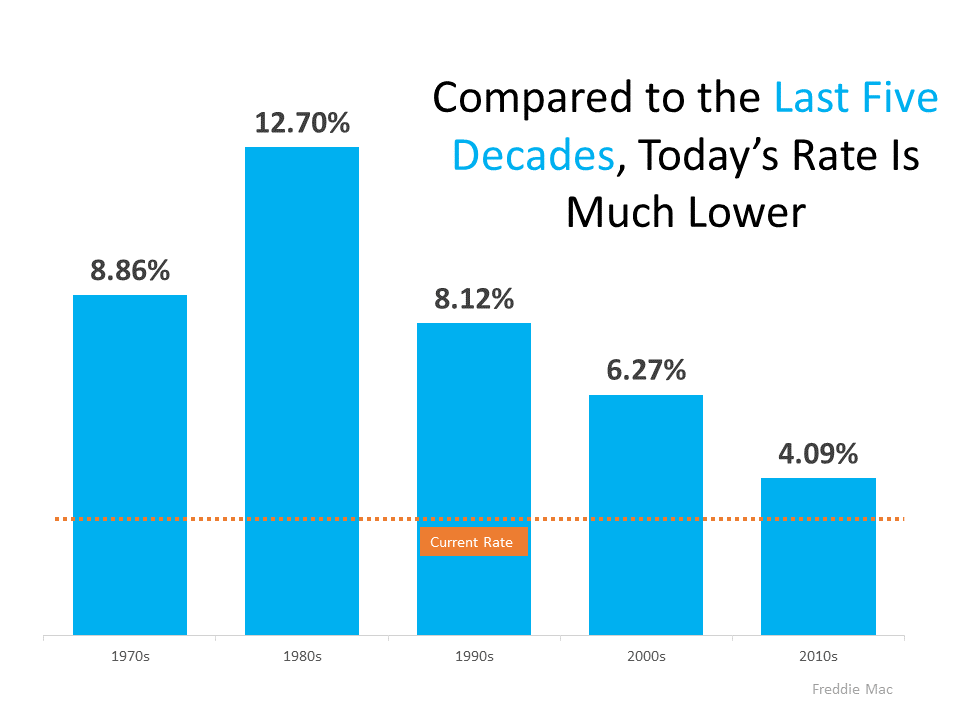

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below): When we look back even further, we can see that today’s rate is truly outstanding by comparison.

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your home buying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they’ve hovered in the historic-low territory. But even over the past few weeks, rates have started to rise. This past week, the average 30-year fixed rate was 3.14%.

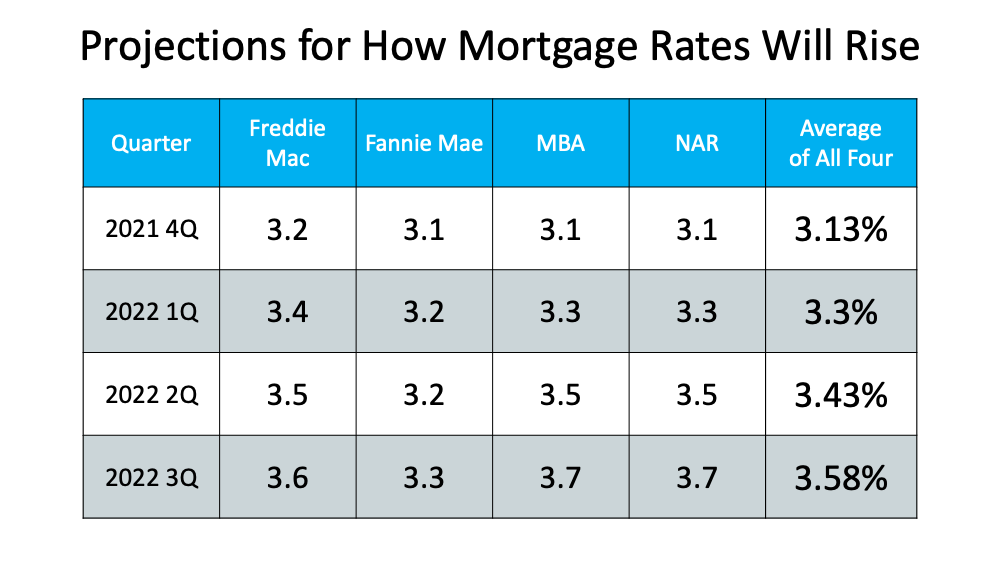

What does this mean if you’re thinking about making a move? Waiting until next year will cost you more in the long run. Here’s a look at what several experts project for mortgage rates going into 2022.

“The average 30-year fixed-rate mortgage (FRM) is expected to be 3.0 percent in 2021 and 3.5 percent in 2022.”

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability.”

“Consensus forecasts predict that mortgage rates will hit 3.2 percent by the end of the year, and 3.7 percent by the end of 2022.”

If rates rise even a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the reality is, as prices and mortgage rates rise, it will cost more to purchase a home.

As you can see from the quotes above, industry experts project rates will rise in the months ahead. Here’s a table that compares other expert views and gives an average of those projections: Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s home buying affordability. That could be just the game-changer you need to achieve your homeownership goals.

Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s home buying affordability. That could be just the game-changer you need to achieve your homeownership goals.

If you’re thinking of buying or selling over the next year, it may be wise to make your move sooner rather than later – before mortgage rates climb higher.

Some Highlights

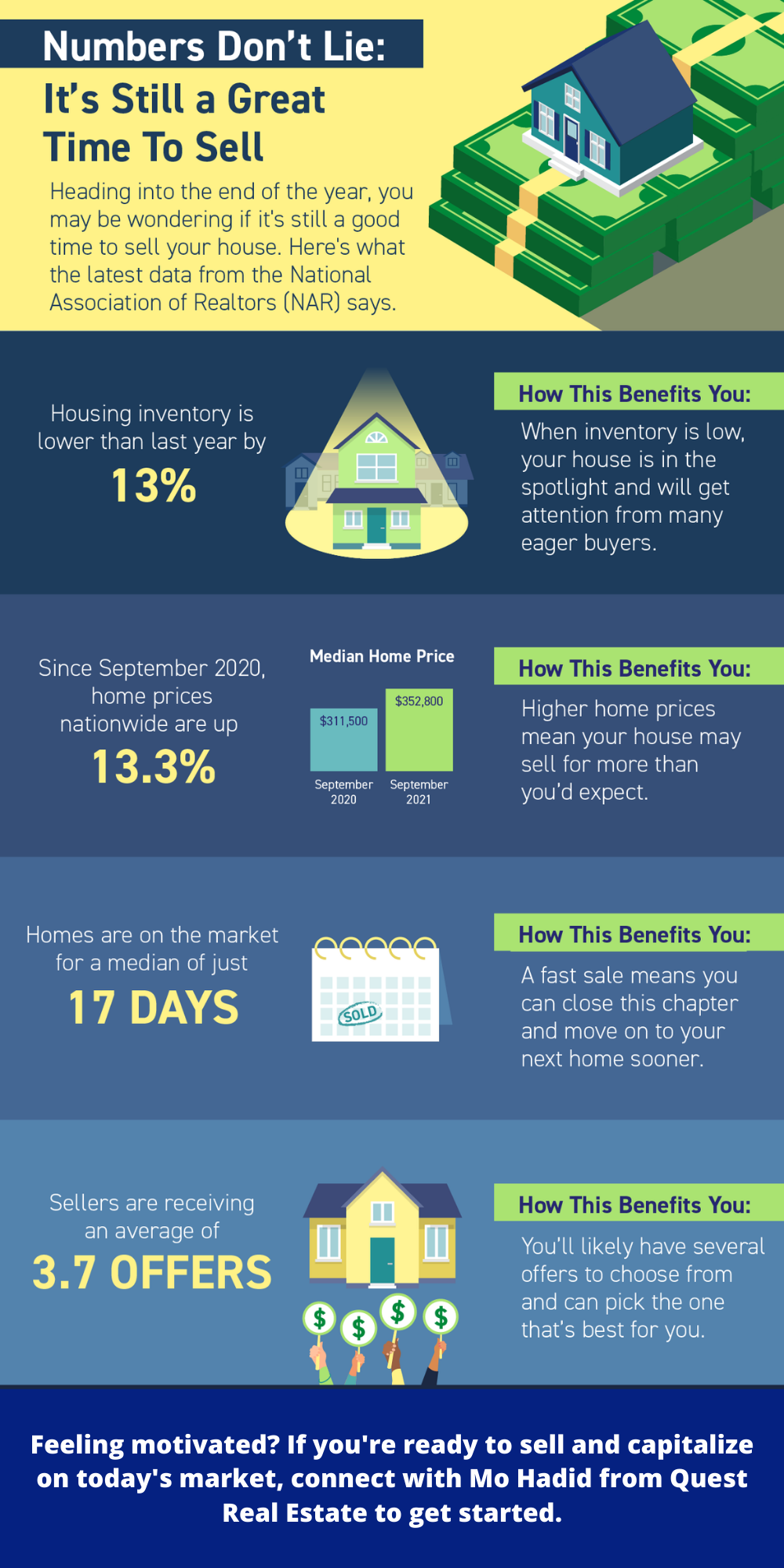

The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced historically.

There are many reasons for the limited number of homes on the market, but as you can see in the graph below, we’re well below where we’ve been for most of the past 10 years. Today, across the country, there is only a 2.4-month supply of homes available for sale.

This lack of homes for sale is creating a challenge for many buyers who are growing frustrated in their search. On the other hand, this is a huge opportunity for sellers as low supply is driving up home values. According to CoreLogic, the average home has appreciated by more than $50,000 over the past year. And for many homeowners, that’s opening new doors as they re-think their needs and use their equity to move up or downsize.

According to Dr. Frank Nothaft, Chief Economist at CoreLogic:

“The average homeowner with a mortgage has more than $200,000 in home equity as of mid-2021.”

Today, many sellers are taking advantage of low interest rates and the equity they have in their homes to make a move.

The biggest challenge in real estate is the lack of homes for sale, but this challenge is also an opportunity for sellers. If you’re thinking about selling your house, let’s connect to start the process.