Expert Insights on the 2022 Housing Market

Wondering what’s coming in the year ahead? Here’s a look at what experts expect from the housing market in 2022.

California REALTOR®

The latest information is available to help you confidently decide whether to buy or sell a home this winter. Let’s connect so you can get the latest digital copies.

There’s no question that the financial benefits of selling a house are outstanding today. Now is truly a great time to list if you’re ready to make a change. But if you do sell your house right now, you may be wondering where you’ll go when you move.

With so few homes available to buy right now, you might be considering building a new home as one of your options. But you may be unsure if that’s the way to go. Let’s compare the benefits of a newly built home versus moving into an existing one, and why working with a real estate agent throughout the process is mission-critical to your success no matter what you decide.

First, let’s look at the benefits of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

When building a home, you can choose energy-efficient options to help lower your utility costs, protect the environment, and reduce your carbon footprint.

Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle. QuickenLoans puts it like this:

“Buying a new construction vs. existing home typically means you’ll have fewer repairs to do. It can be a huge relief to know that it’s unlikely you’ll have to repair the roof or replace the furnace.”

Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal. As Investopedia says, if you buy an existing home:

“Odds are, too, that the home will have mature landscaping, so you won’t have to worry about starting a lawn, planting shrubs, and waiting for trees to grow.”

The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home. According to Houseopedia:

“Charm is priceless. Existing homes, especially those built in the 1950’s or before, often offer architectural elements, historic charm and a quality of craftsmanship not available in new homes.”

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision, so you can move into the home of your dreams.

If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market conditions to purchase a home.

To determine whether you should buy now or wait another year, you can ask yourself two simple questions:

Let’s shed some light on the answers to both of these questions.

Three major housing industry entities are projecting ongoing home price appreciation in 2022. Here are their forecasts:

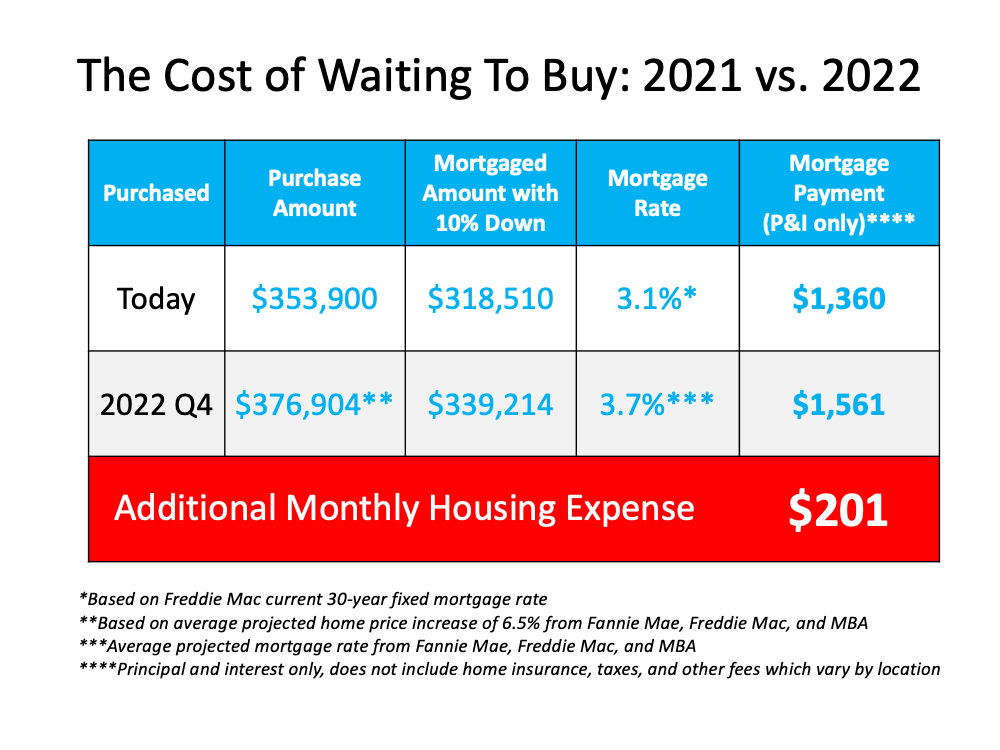

According to the National Association of Realtors (NAR), the median price of a home today is $353,900. Using an average of the three price projections above (6.5%), a home that sold for $353,900 today would be valued at $376,904 at the end of next year. As a prospective buyer, you would therefore pay an additional $23,004 by waiting.

Today, Freddie Mac announced their 30-year fixed mortgage rate was at 3.1%. However, most experts believe mortgage rates will rise as the economy recovers. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

That averages out to 3.7% if you include all three forecasts. Any increase in mortgage rates will increase your costs.

If both variables increase, you’ll pay a lot more in mortgage payments each month. Let’s assume you purchase a $353,900 home today with a 30-year fixed-rate loan at 3.1% (the current rate from Freddie Mac) after making a 10% down payment. According to mortgagecalculator.net, your monthly mortgage payment would be approximately $1,360 (this does not include insurance, taxes, and other fees because those vary by location).

That same home one year from now could cost $376,904, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment after putting down 10%, would be approximately $1,561. The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

Add to that the approximately $23,004 a house with a similar value would build in home equity this year due to home price appreciation, and the total net worth increase you could gain by buying this year is over $95,364 (the $72,360 mortgage savings plus the $23,004 potential gain in equity if you buy now).

When asking if you should buy a home, you may think of the non-financial benefits of homeownership. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year. Contact Mo from Quest Real Estate here.

If you’re living on your own and looking to buy a home, know that you can make your dream a reality with thoughtful planning and the right team of experts. Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person, and that number is growing. Over the past 40 years, the number of sole-person households has nearly doubled, and that’s a trend that’s expected to continue. According to Freddie Mac:

“Our calculation suggests that there will be an additional 5 million sole-person households in the United States by the next decade. This means 42% of the household growth will be contributed by sole-person households, . . .”

If you fall into this category, here are three tips to help you achieve your homeownership goals.

When you buy a home on your own, you have to qualify for your loan based solely on your own finances and credit history. Investopedia says:

“. . . lenders will be looking at just one credit profile: yours. Needless to say, it has to be in great shape. It is always a good idea to review your credit report beforehand, and this is especially true of solo buyers.”

It’s important to find out your score so you know where it falls. If you’re not sure if it’s strong enough or where to focus your energy to improve it, meet with a professional for expert advice on your individual situation.

Next, look into down payment programs so you can get a feel for what you’ll need to save to buy a home. Rob Chrane, CEO of Down Payment Resource, explains:

“Buyers should discuss their program options with their loan officer and real estate agent to make sure they choose the program best suited to their personal needs.”

In this step, lean on the pros to determine what you’re eligible for and what’s right for you.

You should also spend time thinking about what you want. What type of home do you picture yourself in? To answer that question, Quicken Loans shares this advice:

“Think about your lifestyle, what you want out of your home and your needs. Is being close to work important? Do you need a lot of yard space? Do you want an extra bedroom that you can transform into a home office? Condo or detached home? Lots of space for entertaining? It’s all up to you (and your budget).”

Again, a professional can help you balance what you want and how much you should spend on your monthly housing costs to determine what type of home is right for you.

While buying a home solo can feel like a big challenge, it doesn’t have to be. If you lean on the professionals, they can help you navigate these waters and make sure you’re able to take advantage of the great opportunities in today’s housing market (like low mortgage rates) to buy your dream home.

The share of sole-person households is growing. If you’re looking to buy a home on your own, be confident that the dream is achievable. When you’re ready to begin your search, let’s connect so you have expert advice each step of the way.

The game of chess can provide incredible lessons to apply to all aspects of life, including the home buying process. Chess requires you to plan and think about your strategy from the very beginning of the game.

The home buying process, like chess, requires strategy and planning. Here are a few things to keep in mind to ensure your plan is as strong as possible when you begin your home search.

It’s important to have a great opening play when you’re buying a home. And the best move you can make when you begin your home search is getting pre-approved by a lender. You’ve probably already heard this is an important step, but what exactly is pre-approval and what benefits does it provide you?

As Freddie Mac puts it:

“The pre-approval letter from your lender tells you the maximum amount you are qualified to borrow. Getting a pre-approval letter is not a loan guarantee, it simply states how much your lender is willing to lend you. . . .”

And while determining how much you can afford at the start of your search is critical, the pre-approval letter also serves another important purpose. Freddie Mac also notes:

“This pre-approval allows you to look for a home with greater confidence and demonstrates to the seller that you are a serious buyer.”

In the game of chess, a strong opening move signals to your opponent that you’re a serious competitor. As a homebuyer, your pre-approval letter signals to the seller that you’re a serious, interested buyer.

Every step you take to create your strategy as a buyer is important in today’s market. Why? Mortgage rates are still low, but increasing. Prices are going up. There’s a limited supply of homes for sale. These are just a few key variables in today’s market you need to be prepared for.

That means leaning on expert guidance as you plan every move is more important than ever. Have a team of professionals – like your trusted real estate agent and a loan officer – every step of the way to make sure you make the right moves.

Getting a pre-approval letter isn’t just good strategy, it can be game-changing. It allows you to get a full understanding of what you can afford, and it signals to sellers that you’re serious. Let’s connect today to ensure you’re playing chess and being strategic during the home buying process.