Why You Shouldn’t Sell Your House on Your Own

There’s more to selling your house than putting up a For Sale sign. Let’s connect so you have an expert on your side when you’re ready to sell.

California REALTOR®

Why You Shouldn’t Sell Your House on Your Own

There’s more to selling your house than putting up a For Sale sign. Let’s connect so you have an expert on your side when you’re ready to sell.

The latest information is available to help you confidently decide whether to buy or sell a home this winter. Let’s connect so you can get the latest digital copies.

Current real estate conditions are creating great opportunities for sellers. Let’s connect to discuss why you should expect your house to sell quickly in today’s market.

With forbearance plans coming to an end, many are concerned the housing market will experience a wave of foreclosures similar to what happened after the housing bubble 15 years ago. Here are a few reasons why that won’t happen.

After the last housing crash, about 9.3 million households lost their homes to a foreclosure, short sale, or because they simply gave it back to the bank.

As stay-at-home orders were issued early last year, the fear was the pandemic would impact the housing industry in a similar way. Many projected up to 30% of all mortgage holders would enter the forbearance program. In reality, only 8.5% actually did, and that number is now down to 2.2%.

As of last Friday, the total number of mortgages still in forbearance stood at 1,221,000. That’s far fewer than the 9.3 million households that lost their homes just over a decade ago.

Due to rapidly rising home prices over the last two years, of the 1.22 million homeowners currently in forbearance, 93% have at least 10% equity in their homes. This 10% equity is important because it enables homeowners to sell their homes and pay the related expenses instead of facing the hit on their credit that a foreclosure or short sale would create.

The remaining 7% might not have the option to sell, but if the entire 7% of those 1.22 million homes went into foreclosure, that would total about 85,400 mortgages. To give that number context, here are the annual foreclosure numbers for the three years leading up to the pandemic:

The probable number of foreclosures coming out of the forbearance program is nowhere near the number of foreclosures that impacted the housing crash 15 years ago. It’s actually less than one-third of any of the three years prior to the pandemic.

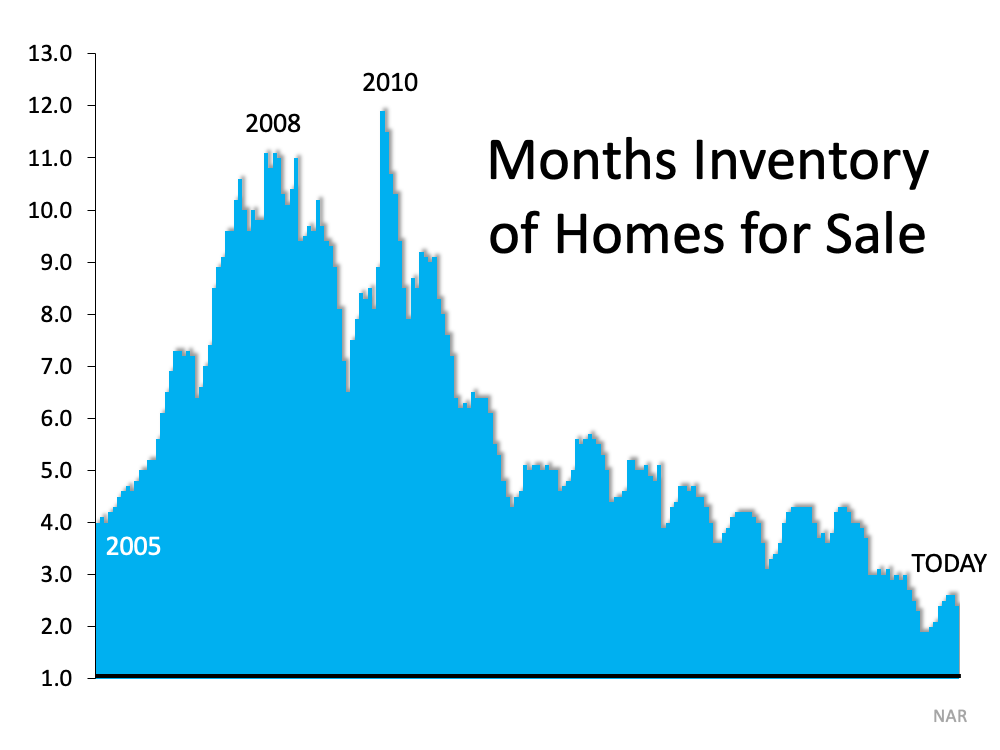

When foreclosures hit the market back in 2008, there was an oversupply of houses for sale. It’s exactly the opposite today. In 2008, there was over a nine-month supply of listings on the market. Today, that number is less than a three-month supply. Here’s a graph showing the difference between the two markets.

The data indicates why Ivy Zelman, founder of the major housing market analytical firm Zelman and Associates, was on point when she stated:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Have more questions? Contact Mo Hadid with Quest Real Estate for answers.

![Should I Update My House Before I Sell It? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/11/10102242/20211112-MEM-1046x1723.png)

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

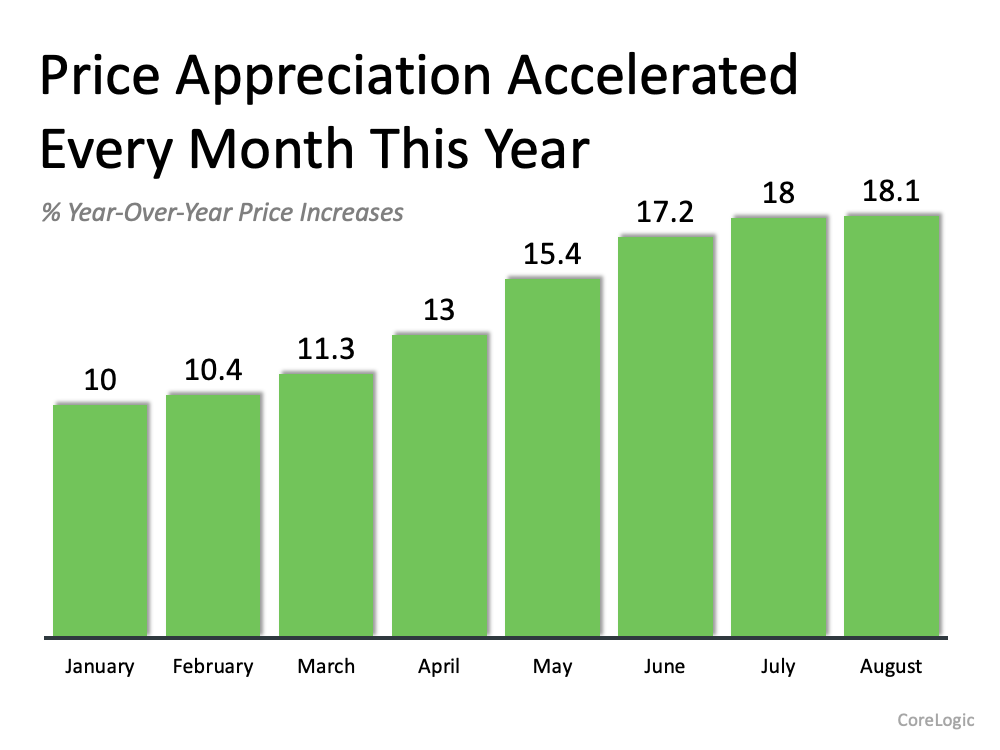

According to the latest Home Price Index from CoreLogic, home values have increased by 18.1% compared to this time last year. Additionally, prices have gone up at an accelerated pace for each of the last eight months (see graph below): The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

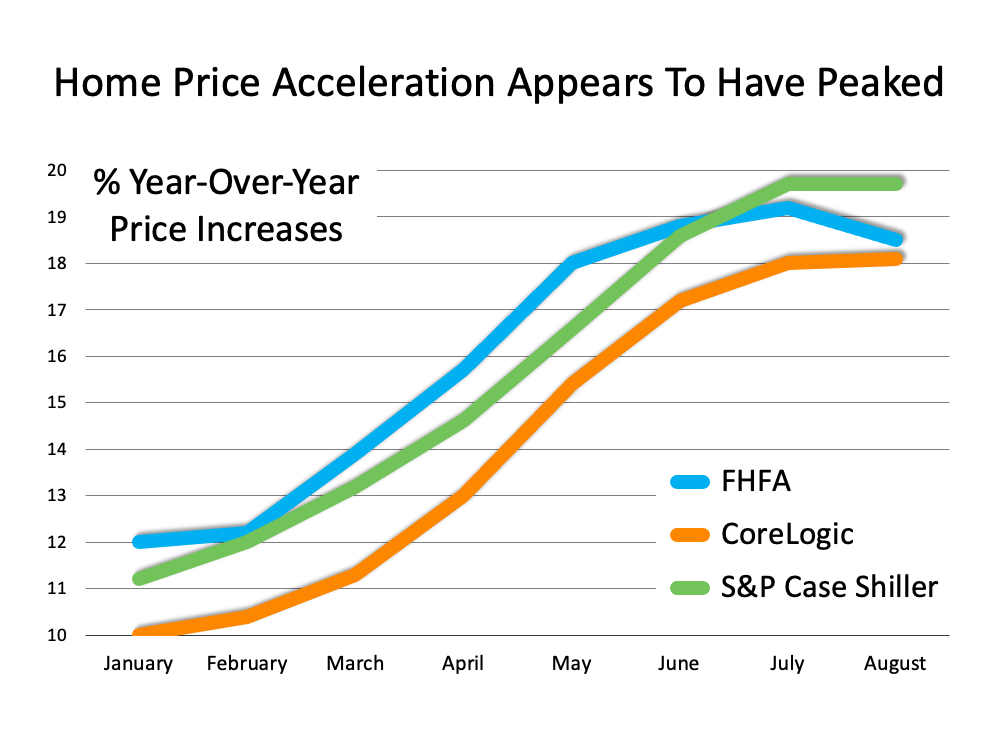

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The last year has shown tremendous home price appreciation, which is resulting in a major gain in wealth for homeowners through rising equity.

All three indices mentioned above also show that while appreciation is in the high double digits right now, that price acceleration is beginning to level off (see graph below): Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Keep in mind, that doesn’t mean home values will depreciate. It means the rate of appreciation will slow, yet stay well above the 25-year average of 5.1%.

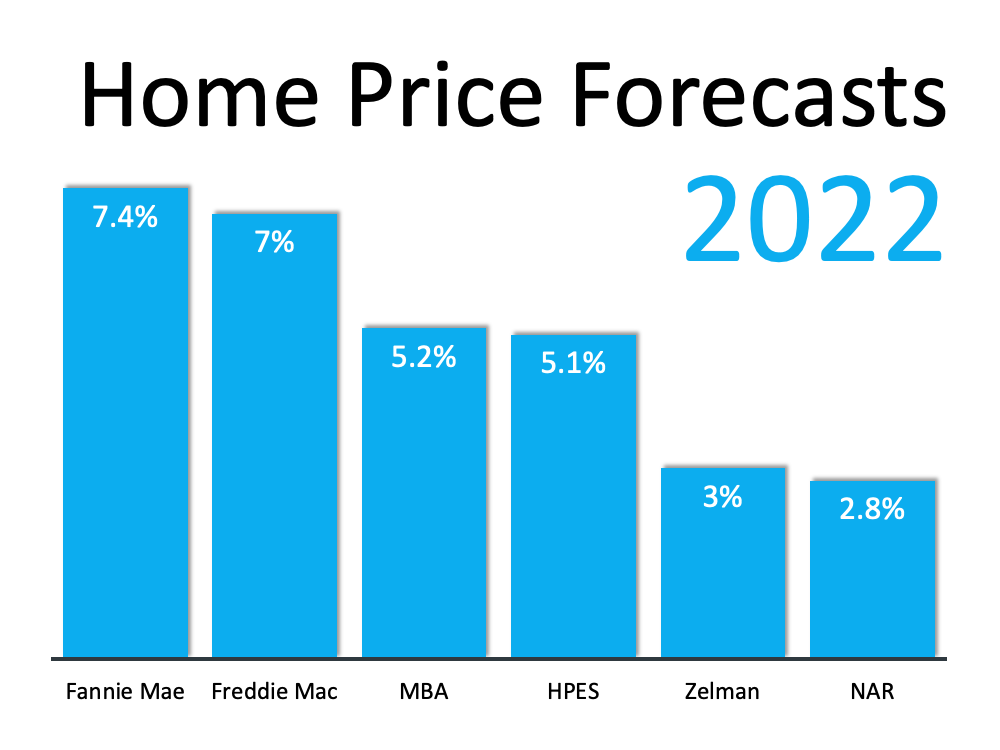

The recent surge in prices is the result of heavy buyer demand and a shortage of homes available for sale. Most experts believe that as more housing inventory comes to market (both new construction and existing homes), the supply and demand for housing will come more into balance. That balance will bring a lower rate of appreciation in 2022. Here’s a look at home price forecasts from six major entities, and they all project future appreciation:

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

There have been historic levels of home price appreciation over the last year. That pace will slow as we finish 2021 and enter into 2022. Prices will still rise in value, just at a much more moderate pace, which is good news for the housing market.