Experts agree that the housing market is still strong this fall and gives both buyers and sellers unique opportunities. Contact Mo Hadid at Quest Real Estate if you’re ready to make a move this season.

California REALTOR®

Experts agree that the housing market is still strong this fall and gives both buyers and sellers unique opportunities. Contact Mo Hadid at Quest Real Estate if you’re ready to make a move this season.

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home.

To determine if you should buy now or wait, you need to ask yourself two simple questions:

Let’s shed some light on the answers to both of these questions.

Three major housing industry entities project continued home price appreciation for 2022. Here are their forecasts:

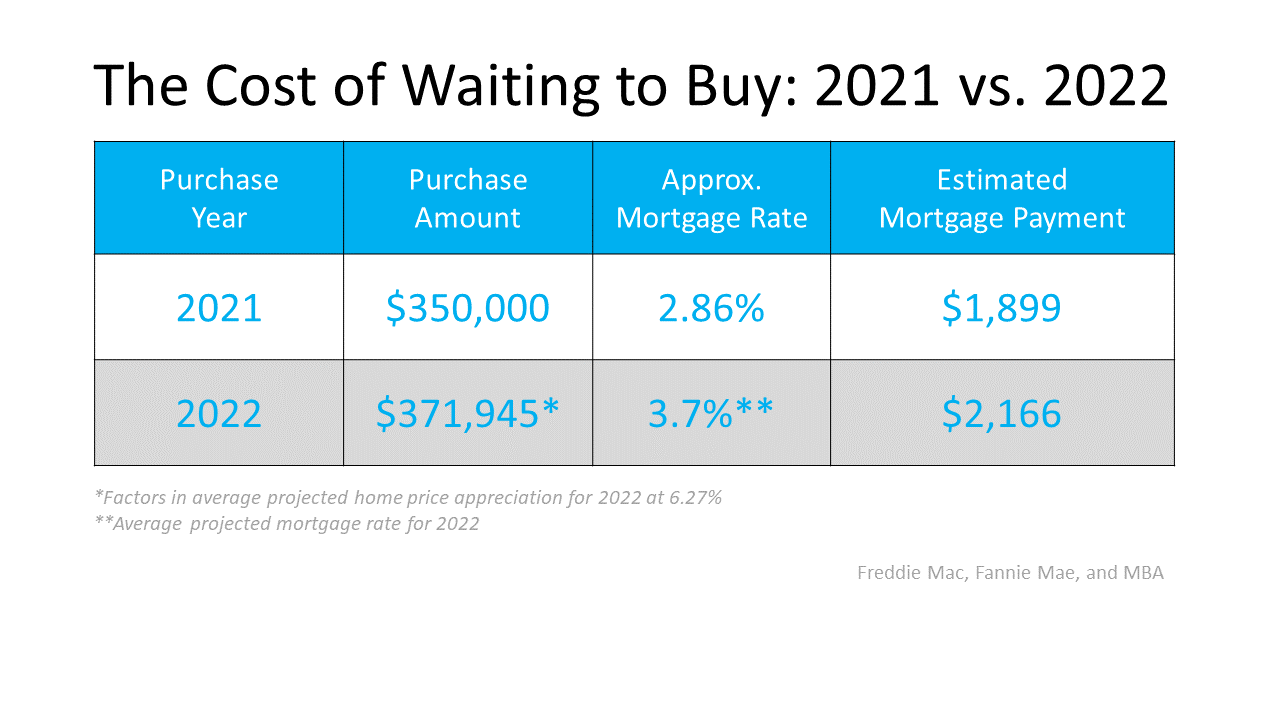

Using the average of the three projections (6.27%), a home that sells for $350,000 today would be valued at $371,945 by the end of next year. That means, if you delay, it could cost you more. As a prospective buyer, you could pay an additional $21,945 if you wait.

Today, the 30-year fixed mortgage rate is hovering near historic lows. However, most experts believe rates will rise as the economy continues to recover. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

That averages out to 3.7% if you include all three forecasts, and it’s nearly a full percentage point higher than today’s rates. Any increase in mortgage rates will increase your cost.

You’ll pay more in mortgage payments each month if both variables increase. Let’s assume you purchase a $350,000 home this year with a 30-year fixed-rate loan at 2.86% after making a 10% down payment. According to the mortgage calculator from Smart Asset, your monthly mortgage payment (including principal and interest payments, and estimated home insurance, taxes in your area, and other fees) would be approximately $1,899.

That same home could cost $371,945 by the end of 2022, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment, after putting down 10%, would increase to $2,166.

The difference in your monthly mortgage payment would be $267. That’s $3,204 more per year and $96,120 over the life of the loan.

If you consider that purchasing now will also let you take advantage of the equity you’ll build up over the next calendar year, which is approximately $22,000 for a house with a similar value, then the total net worth increase you could gain from buying this year is over $118,000.

When asking if you should buy a home, you probably think of the non-financial benefits of owning a home as a driving motivator. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year.

Fall is quickly approaching and it could pose the perfect opportunity to sell your home. There is no doubt that we are in a seller’s market. Homes are selling at record speeds for top dollar, but it won’t last forever. Keep reading to learn our top five reasons to put your house on the market this Fall.

Your House Will Likely Sell Quickly

Average days on market is a strong indicator of buyer demand. Currently, properties are spending a short amount of time on the market, which is a good indicator that your home could sell just as quickly.

Buyers Competition

Not only are homes selling quickly, but they are also seeing multiple offers. Buyers are coming prepared with the best offer in hand because they know that bidding wars are a likely outcome. Multi offer situations can put the seller in a great financial position.

Inventory is Low

Motivated buyers are challenged with the low housing supply. When inventory is low and demand is high, then your house takes center stage. This sets you up for success by drawing more attention to your home. Now is the time to take advantage of the low inventory before the supply starts to increase.

Home Equity

Competition is driving up the price and causing home price appreciation to rise. As the home’s value appreciates, equity will also increase. This is good news for sellers because the increasing value of your home can give you more money in your pocket to upgrade.

Low Mortgage Rates

Buyers are motivated to purchase thanks to the record low mortgage rates. Throughout 2021 mortgage rates have been low, however, the hot housing market and accelerating inflation point to a probable rise in interest rates by the end of the year. Now is the time for homeowners to take advantage of the rates and lock in unprecedented savings.

Seller’s markets won’t last forever so act now. If you are interested in selling your home contact Mo Hadid with Quest Real Estate today! Click here to discover what your home could be worth today.

Sellers have heard that the low supply of homes is good news. Low supply and high demand create the perfect conditions to sell your home. Being in a seller’s market means your home sells quickly for higher profit. Let’s take a look at the current market conditions and the impact it has on the sale of your home.

What has caused the inventory shortage? The pandemic has influenced inventory shortages but it isn’t solely to be blamed. The uncertainty of the pandemic caused sellers to hold off on listing their homes, which leads to fewer existing homes being available on the market. The truth is the low inventory of homes on the market has been a long time coming. Over the past couple of years, new construction has slowed down. Fewer homes are being built and added to the market despite the increased demand. Now, contractors face challenges from the supply chain, increase building costs, and labor shortages. The low inventory gives control to the sellers, but an inventory increase can shift the control toward the buyers especially if the demand decreases.

There has been an increase in people desiring to purchase homes. People have spent more time at home and are realizing it doesn’t fit their needs. Additional buyers have been added with the entrance of Millennials into the market. The increased interest combined with low-interest rates has dramatically driven up the demand to purchase a home. More buyers in the market create competition and contribute to the perfect conditions to sell.

The influx of buyers combined with the shortage of homes presents the right time to sell your home. The housing supply is still historically low, but it won’t stay that way for long. Take advantage of the seller’s market and use your increasing equity and low-interest rates to make your next move. Contact us today to learn your options.